Are You Interested in Purchasing a Home?

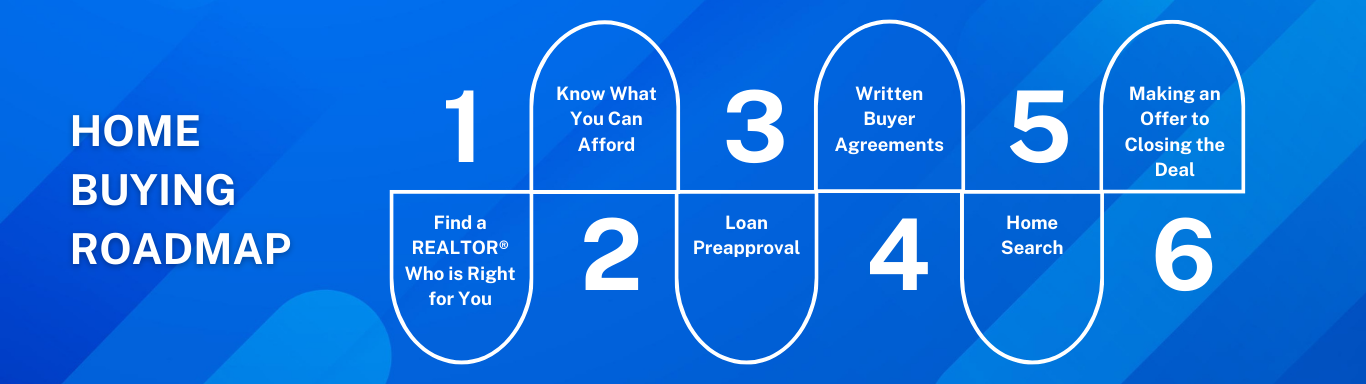

. From beginning to end, we have outlined the general process to help you start your journey to homeownership! Every transaction is different which is why it is so important to build your team of knowledgeable professionals to help you navigate one of the largest transactions you will make! Check out our resources below.

Before beginning your homebuying journey, you’ll want to find a REALTOR® with insight into local market conditions and who will be able to guide you through the process, explain your options and answer your questions along the way. Buying a home is one of the largest financial decisions you will make. While the homebuying process can be overwhelming and stressful, with preparation and a valued REALTOR® by your side, it can be an exciting and rewarding experience.

While many consumers believe the term “REALTOR®” refers to all real estate agents, it refers exclusively to real estate professionals who belong to the National Association of REALTORS®. As members of NAR, REALTORS® subscribe to a strict Code of Ethics that goes above and beyond the requirements of state licensing law. REALTORS® are dedicated to protecting consumers, guiding homebuyers and sellers and supporting their local communities.

Don't be afraid to interview a few REALTORS® to help you find the REALTOR® that is right for you! Here are some sample interview questions to help get you started. Keep in mind, you should also inquire about their experience in the geographic area you are looking to purchase in as well as the property types you are looking at potentially purchasing. Central and Eastern Oregon are unique and the markets our members serve can be very different. Are you ready to start your home buying journey? Find your REALTOR® today! Find a REALTOR®

There are several things you need to consider when determining how much you can afford when purchasing a home-monthly mortgage payments, a down payment, closing cost and moving expenses. Here are some helpful tips to determine how much you can afford as you start your home buying journey.

If you need a mortgage loan to buy your new home, you'll need to figure out how much you can afford to pay each month. The first step is taking inventory of your current bills. Make a list of your monthly expenses and add them up. These expenses can include auto loans, food costs, utilities, and insurance costs. Divide your total expenses by your monthly income to find your debt-to-income ratio. Mortgage lenders will use a similar calculation to determine the amount of disposable income you have to afford your monthly mortgage payment. Lenders can also discuss your credit score which will impact your monthly mortgage payment.

Most loans require a down payment. This amount can differ depending on the lender you choose and the programs they offer that you may qualify for. Buyers who make down payments of less than 20% may also be required to purchase mortgage insurance which can also impact your monthly mortgage payment. A lender can discuss these options with you so that you can explore what option is best for you when purchasing a property.

Closing costs are fees paid to third parties at the close of the transaction to facilitate the transaction. These include lender fees, title fees, associated taxes and more. Chat with your REALTOR® and lender about what type of closing costs you should expect and how much you should budget for. Also, don't forget to budget for potential moving costs and home improvement expenses when you are developing your budget.

Once you have an idea of the budget you would like to work with, you should start interviewing lenders. Don't be afraid to interview several lenders to find the right lender for you! Here are some sample interview questions to help you get started. We have many mortgage lenders who are affiliate members and trusted professionals to help guide you through your mortgage process. Find an Affiliate

Getting a preapproval letter from your lender will let your REALTOR® know you're ready to start looking at homes. This will also help you to know what price range of properties you should consider in order to stay within your budget comfortably. Your lender will give you a list of documents you will need to compile for them to determine your preapproval such as previous tax returns, proof of income, bank statements, proof of funds for down payment and closing costs and personal identification documentation. We recommend you get this list from the lender you select upfront so that you can get these compiled and get preapproved before you start looking at homes. Keep in mind, preapproval does not guarantee that you will be approved for a loan. It also doesn't lock you in to a specific lender. You may find a better rate from another lender later in your home buying process. Make sure to keep your REALTOR® apprised of any changes to your lending throughout the process.

REALTORS® representing buyers are required to have a written agreement with buyers prior to showing homes. These agreements typically review the services the buyer will be provided in exchange for the compensation the buyer's agent will receive for their work during your home buying process. Find out more about what is required in these agreements per a recent national legal settlement. This guide will help consumers understand why they are being required to sign an agreement with their buyer's agent. The goal of this agreement is to bring clarity and transparency to buyers during their transaction on the services they will receive and how their buyer's agent will be paid. Compensation is always negotiable and is an important conversation to have at the onset of your relationship with your REALTOR® so that everyone understands the expectations throughout the transaction.

Here's a look at all the things — big and small —that a REALTOR® may do to help clients when buying a home. This list will explain the value a REALTOR® brings to your transaction and why they are worth every penny of their compensation.

Now that you have your loan preapproval and have found your REALTOR®, you are ready to start your home search! Start thinking about your wants and needs for your future home. Every buyer and their needs are different so it is important to talk over what you are looking for in a property in detail with your trusted REALTOR®. Here are some common items to consider:

- Property Type-Residential, Farm, Condo/Townhome etc.

- Geographic area

- Square footage and lot size

- Number of Bedrooms and Bathrooms

- Parking Options

- Other amenities

Once you have a defined list of what your priorities are for your new home, your REALTOR® can schedule showings for homes that best match your wants and needs while staying within your budget.

Once you have found the home you would like to purchase, your REALTOR® will help you make your initial offer. They will provide you valuable insight on what a competitive offer may be considering current market conditions and based on comparable properties that have recently sold. At this point, you will be able to condition your offer on what title company you would like to close with. Title companies handle the closing of the property you purchase. We recommend reaching out to several title companies to determine what services they offer, what their fees are and determine what is the right fit for you. We have several title companies who are affiliate members who are trusted professionals here to help you get your home closed! Are you looking for a title company? Check out our list of title companies. Find an Affiliate

Once your offer is accepted, you will most likely need a check to submit with your offer for earnest money. Discuss this with your REALTOR® in advance of writing an offer. Your REALTOR® can advise you about the exact figure and conditions with your earnest money. If your offer is not accepted, you can continue shopping for a home until one is accepted. Everyone's home buying experience differs in experience and length. If it is taking longer than expected, talk to your REALTOR® to re-evaluate your list of priorities. Being open to different options can expand your housing choices.

One a seller accepts your offer, it's time to start the formal mortgage application process. This can be a time consuming process, so ask your lender in advance for a list of documents you will need so that you can be prepared to send them over when you are ready to submit a mortgage application.

A home inspection will help ensure that your new home is structurally sound and that you have an idea of any major repairs that may need to be completed now or in the near future. It is also helpful to find out through a home inspection the age of major appliances or structural items such as roof so that you have an idea of if and when you may be expected to replace those items in the future if you purchase the home. We have many many home inspectors who are affiliate members and trusted professionals to help guide you through your mortgage process. Are you looking for a home inspector? Ask your REALTOR® or check out our list of home inspectors. Don't be afraid to interview several inspectors to find the right home inspector for you! Here are some sample questions to help you interview home inspectors. Find an Affiliate

Your lender will also arrange for a home appraisal to confirm the value is a good match for the loan amount. Your REALTOR® will help you through this process. Once your home inspection period has concluded and your appraisal is completed, you are ready to close on your new home!

There will be plenty of documents to sign when you close on your new home. Your REALTOR® can help you prepare these documents, understand each one and answer any questions you may have. During closing, you will be responsible for providing funds for your down payment and closing costs. Your lender will provide the exact amount you owe at closing based on the home you've chosen and the purchase price. Once you have closed, YOU ARE A HOMEOWNER! Congratulations!

Additional Resources

In addition to the links below, the Cascades East Association of REALTORS® has created a consumer guides page to help explain important parts of the home buying and selling process which also includes important information on recent practice changes in the real estate industry that consumers should be aware of and understand. We recommend checking out the consumer guide page to start familiarizing yourself with these recent changes as they impact real estate transactions.

- Everything Guide to Buying Your First Home

- Your Questions Answered: Best Home Buying Tips for First-Timers

- 6 Reasons You Should Never Buy a Home without a REALTOR®

- 10 Tips for Buying a New Home

- Difference Between a Buyer's Agent and Listing Agent

- What You Should Really Know About Browsing for Homes Online

- How to Be Showing Savvy